Insurance Rates for Waldport based on the National Flood Insurance Program

More accurate rates based on improved levels of data and analysis.

Posted on: September 21, 2021 - 10:38am

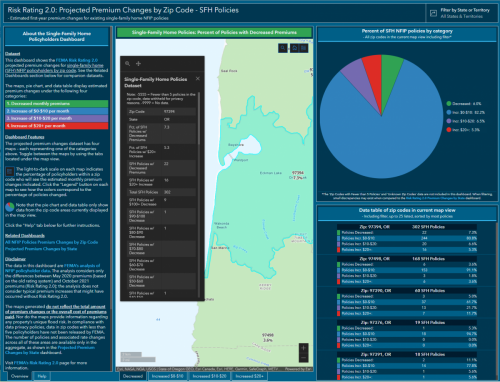

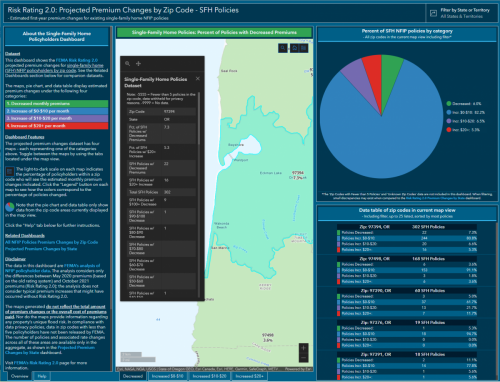

New Interactive Maps Provide Visibility into Flood Insurance Premium Changes Coming with FEMA’s Risk Rating 2.0

Get an accurate national and local snapshot of projected rate decreases and increases with interactive online tools

Follow this link to determine Flood Insurance rates for your zip code. Most properties within Waldport and the region are eligible for rate decreases. Please check with your insurance agent.

MADISON, WI – September 21, 2021 – The Association of State Floodplain Managers (ASFPM), in collaboration with The Pew Charitable Trusts, today unveiled interactive maps that show where flood insurance rates are expected to decrease, increase, or remain the same — and by how much — under the Federal Emergency Management Agency’s (FEMA) new pricing structure: Risk Rating 2.0: Equity in Action.

Starting October 1, Risk Rating 2.0 will fundamentally change the way FEMA rates a property’s flood risk and prices insurance for the more than five million National Flood Insurance Program (NFIP) policyholders.

The new methodology incorporates more flood risk data variables to more accurately reflect a property’s individual flood risk, including the frequency and types of flooding, such as river overflow, storm surge, coastal erosion, and heavy rainfall — and the distance to a water source along with property characteristics, such as elevation and the cost to rebuild. Including a property’s replacement cost value in the new methodology was a major component in the delivery of equitable rates.

ASFPM developed the maps as a more user-friendly format for floodplain management professionals, practitioners, and local leaders to gain greater insight into the new rating system so they can better understand and communicate what’s occurring in their communities.

“There is a fair amount of information available on Risk Rating 2.0 but getting that data out of spreadsheets is challenging. This new tool should help,” said Chad Berginnis, ASFPM’s executive director. “Floods are this nation’s most frequent and costly natural disasters and the trends are worsening. It’s important that people know their risk and buy flood insurance to help protect their homes and businesses. It’s equally important that communities take steps to minimize flood risk.”